crypto tax calculator uk

Crypto Tax Calculator is one of them designed specifically for HMRC tax laws. UK Crypto Tax Calculator.

Best Bitcoin Tax Calculator In The Uk 2021

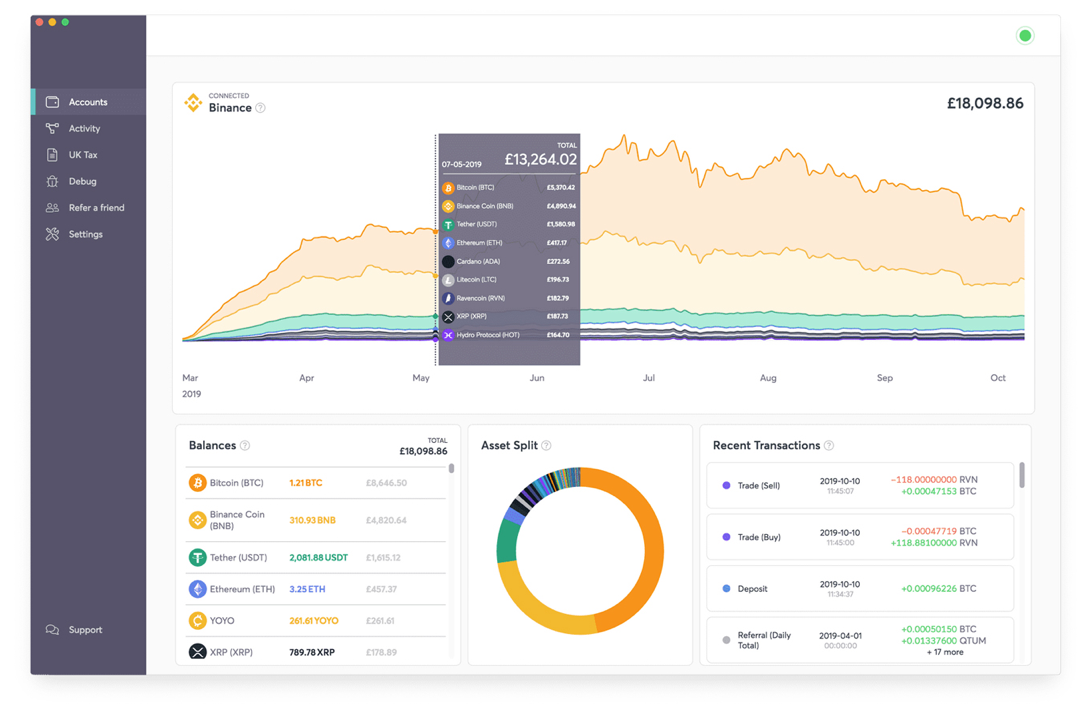

Picks up all transactions across main exchanges metamask even OpenSea.

. Its important that you report your profits accurately and pay any tax due by the deadline if you want to avoid financial penalties. Since then its developers have been creating native apps for mobile devices and other upgrades. Key crypto tax guidance takeaways.

Crypto Tax UK Guide for 2022. If youre not sure whether you need to pay tax or how much tax you will need to pay weve got. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

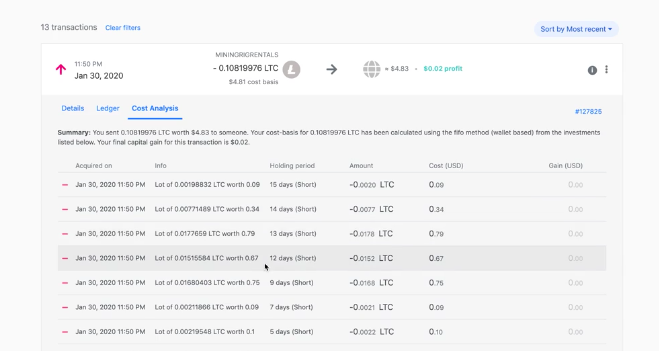

You have investments to make. Discover how much taxes you may owe in 2021. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales.

You pay 127 at 10 tax rate for the next 1270 of your capital gains. Log in with Google. This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication.

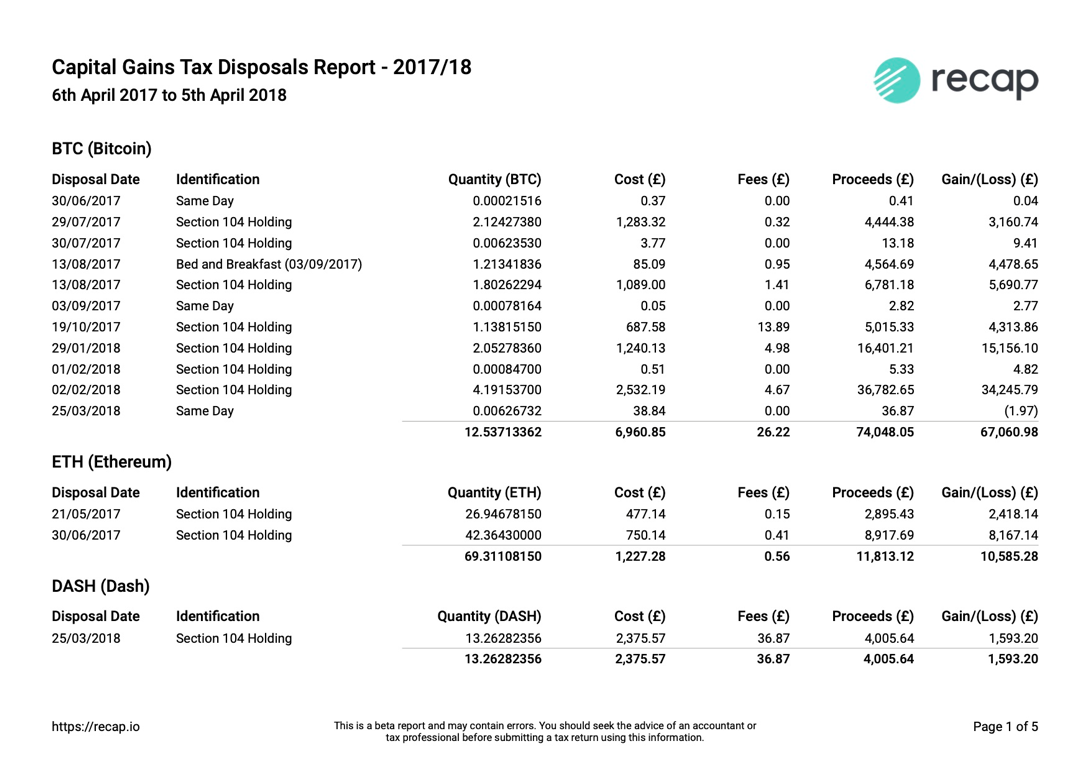

Generate a comprehensive disposal report for your accountant. Cryptocurrency Tax Calculator. How to calculate your UK crypto tax.

They will be liable to pay capital gains tax when they dispose of. And when it came to my 200 Eth transactions it looks like it has reconciled them all. Stay focused on markets.

The platform is also to start using Koinlys crypto tax calculator. We offer full support in US UK Canada Australia and partial support for every other country. Log in to your account.

It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines. The original software debuted in 2014. Stop worrying about record keeping filing keeping up to date with.

8 articles in this collection Written by Shane Brunette and. The formula we use to calculate these capital gains and losses is as follows. UK citizens have to file their capital gains from crypto trading on a special Capital gains summary form.

Your first 12570 of income in the UK is tax free for the 20212022 tax year. Calculate your gains by applying same day 30 day and asset pooling rules. Advice and answers from the CryptoTaxCalculator Team.

Demystify Crypto Taxes All blog post Tag. CoinTrackinginfo - the most popular crypto tax calculator. Anyone in the UK who has had dealings with cryptocurrencies may need to pay tax.

12570 Personal Income Tax Allowance. BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. Calculate and report your crypto tax for free now.

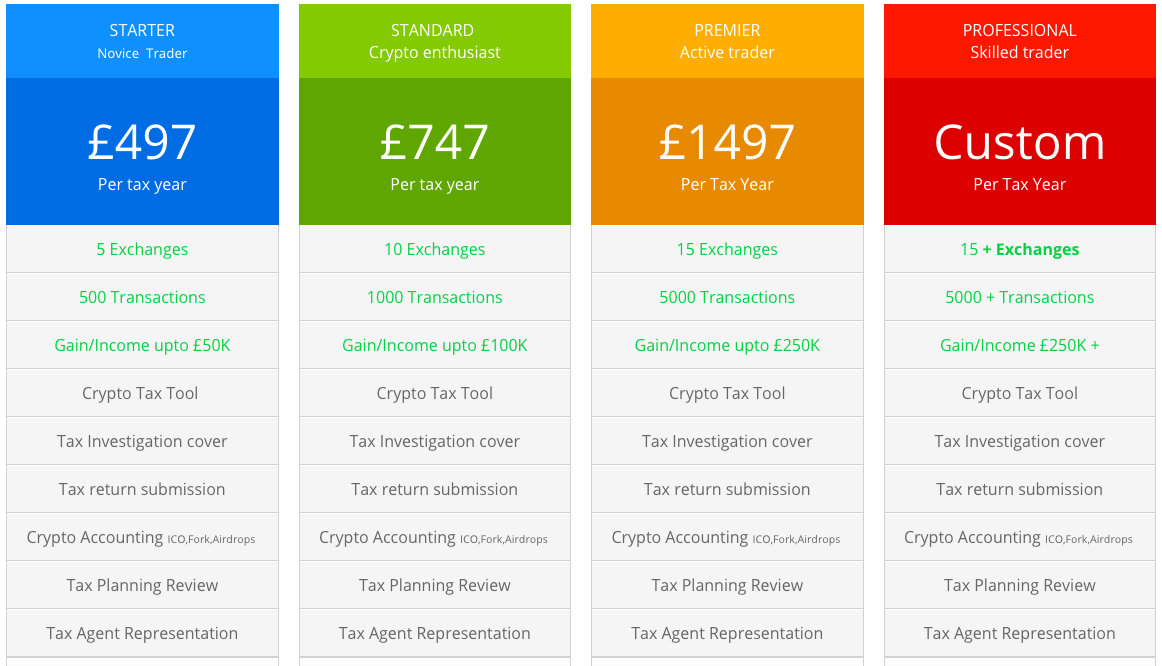

If you have less than 100 cryptoasset transactions per year it may be worthwhile to pay the price of 39 per year to double-check if all of your crypto taxes are in order. This allowance was 12500 for the 20202021 tax year. The Definitive Guide to UK Crypto Taxes 2022.

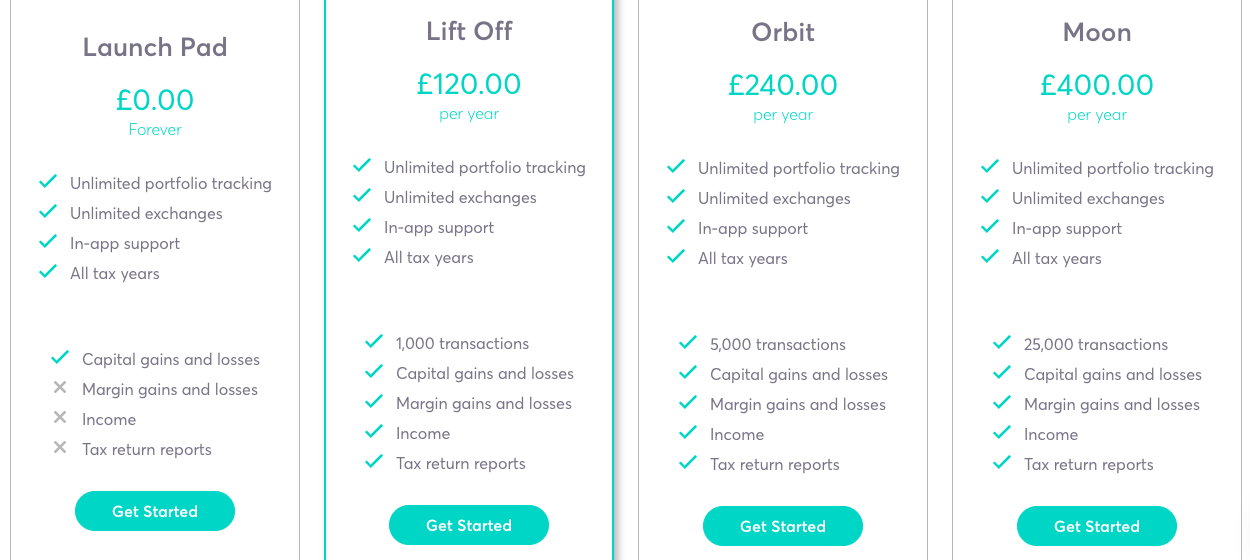

Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. Are you prepared for tax season. For example if you made a total of more than 12300 in capital gains including profits from selling crypto in the tax year 2021-22 youll need to pay tax.

Let us handle the formalities. Online Crypto Tax Calculator with support for over 400 integrations. Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains.

A concise guide on how to use CryptoTaxCalculator. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD. Capital gains tax CGT breakdown.

Crypto Tax Calculator Help Center. Get help with your crypto tax reports. Fair Market Value - Cost Basis GainLoss.

Straightforward UI which you get your crypto taxes done in seconds at no cost. Koinly helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat.

Calculating crypto capital gains. HMRC has published guidance for people who hold. 49 for all financial years.

Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains. This matters for your crypto because you subtract. Log in Sign Up.

You pay no CGT on the first 12300 that you make. The tax youll pay depends on several factors including the type of crypto gain or income and other gains youve made in the same tax year. UK capital gains and income tax support.

Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how. Thankfully the numbers seemed to align with my calculations on simpler CGT disposals. Crypto tax calculator seems like a really robust bit of software.

With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains. In the examples above the capital gains calculation is extremely straightforward as there are only two transactions to account for.

Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. Automated Crypto Trading With Haru. See your crypto capital gains and income since your first investment.

Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year. Read The Ultimate Crypto Tax Guide. According to HMRC the body responsible for crypto taxes in tje UK in the vast majority of cases individuals hold crypto assets as a personal investment usually for capital appreciation or to make particular purchases.

Wade S Cryptocurrency Trading Journal Tax Calculator Spreadsheet Amazon Co Uk Software

Uk Tax Rates For Crypto Bitcoin 2022 Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Uk Tax Rates For Crypto Bitcoin 2022 Koinly

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

![]()

Cointracking Crypto Tax Calculator

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Best Bitcoin Tax Calculator In The Uk 2021

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

![]()

Cointracking Crypto Tax Calculator

The Definitive Guide To Uk Crypto Taxes 2022 Cryptotrader Tax

How Are Bitcoin And Other Crytpocurrencies Taxed Jean Galea

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

Calculate Your Crypto Taxes With Ease Koinly

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog